PAGE LINKS

USEFUL LINKS

CONTACT INFO

- 855-491-0400

- support@rra.agency

- 1309 Coffeen Avenue, Suite 3851, Sheridan, WY 82801

HOME / CASE STUDY

Robert, age 66

Donna, age 62

Pre-retirement income – $120,000

After-tax income needed in retirement – $90,000

Anticipated inflation rate – 3%

Anticipated rate-of-return – 5%

No life insurance

No long-term care insurance

Their Assets:

Taxable bucket – $500,000 (local bank/CDs)

Tax-deferred bucket – $1,500,000 (Carlos’s IRA)

Tax-free bucket – $0

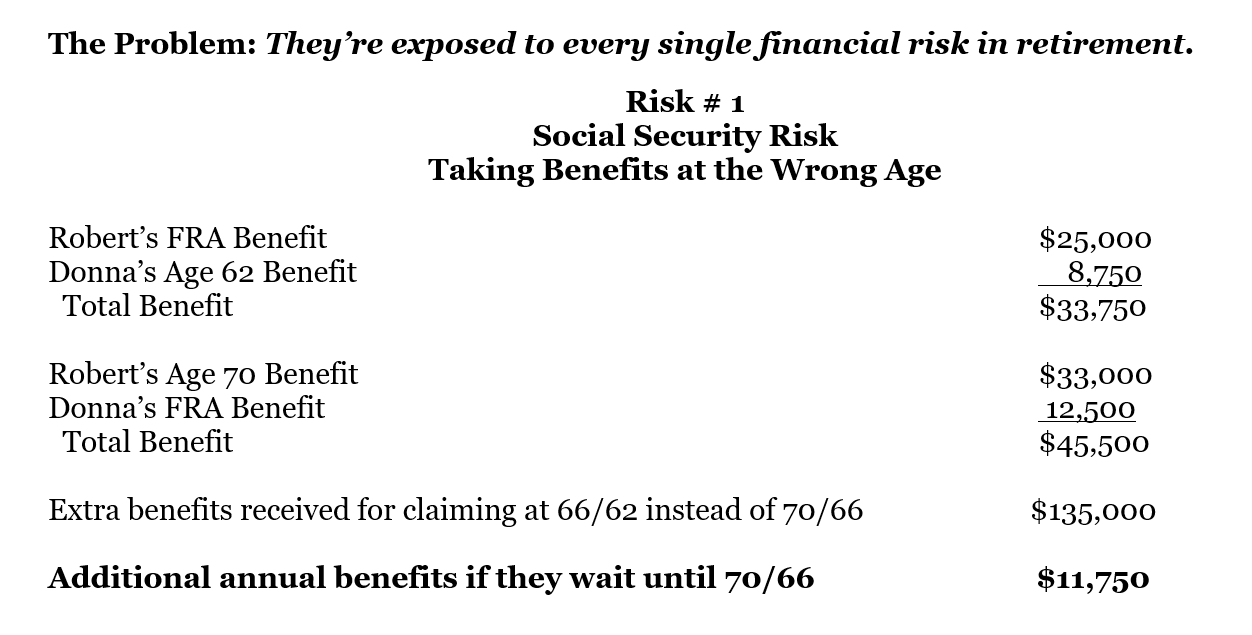

Combined Social Security assuming a full retirement age of 66 – $33,750

In their situation breakeven is 11.5 years at Robert’s age 81.5 and Donna’s age 77.5. Assuming they live to the average life expectancy of 84/88, they will get an additional $93,375 in benefits.

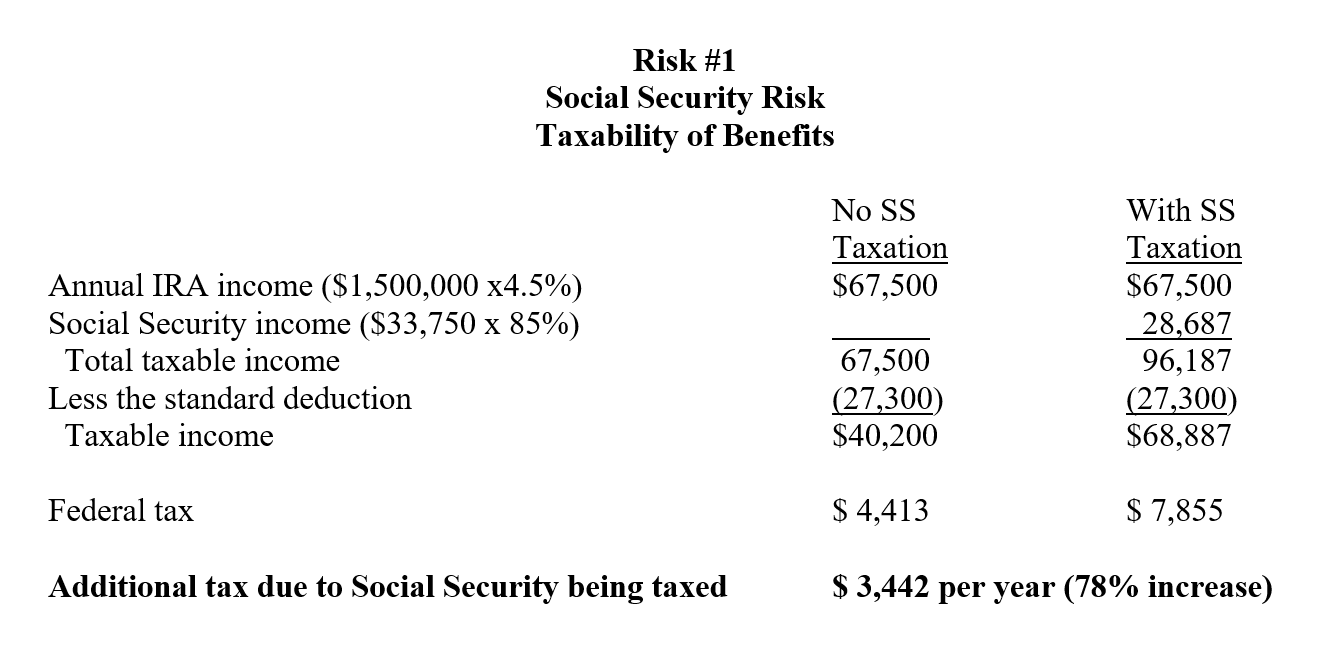

The additional tax will cause the Deckers to spend down their money more each year, causing a loss of their retirement funds 5-7 years sooner.

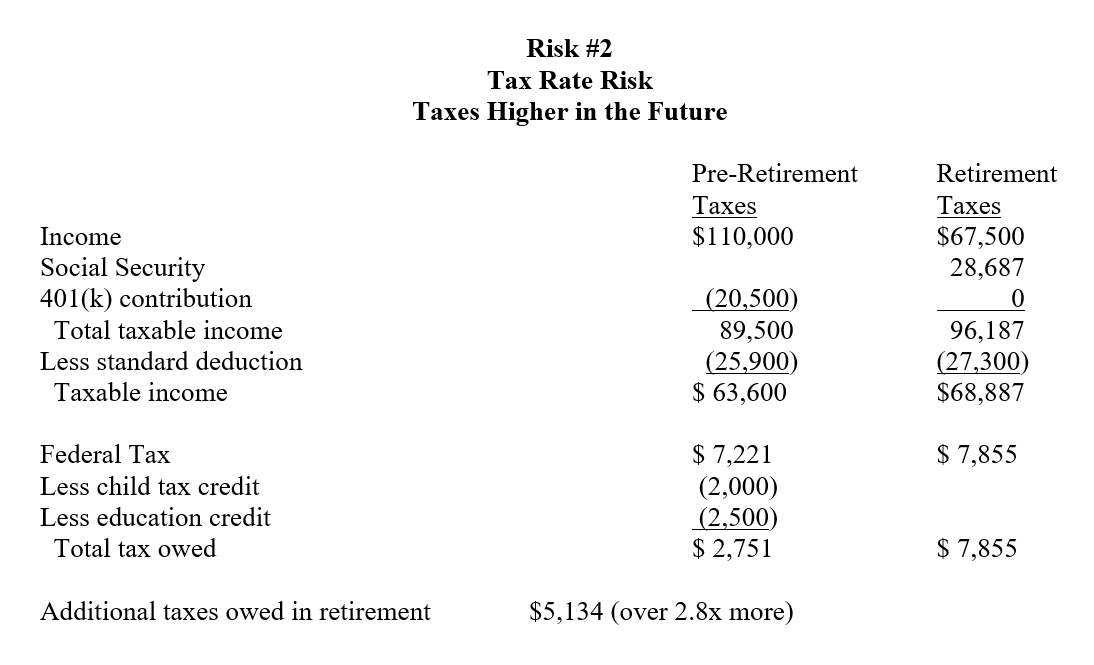

The Deckers lost their tax deductions in retirement. So while their gross income went down, their taxable income went up.

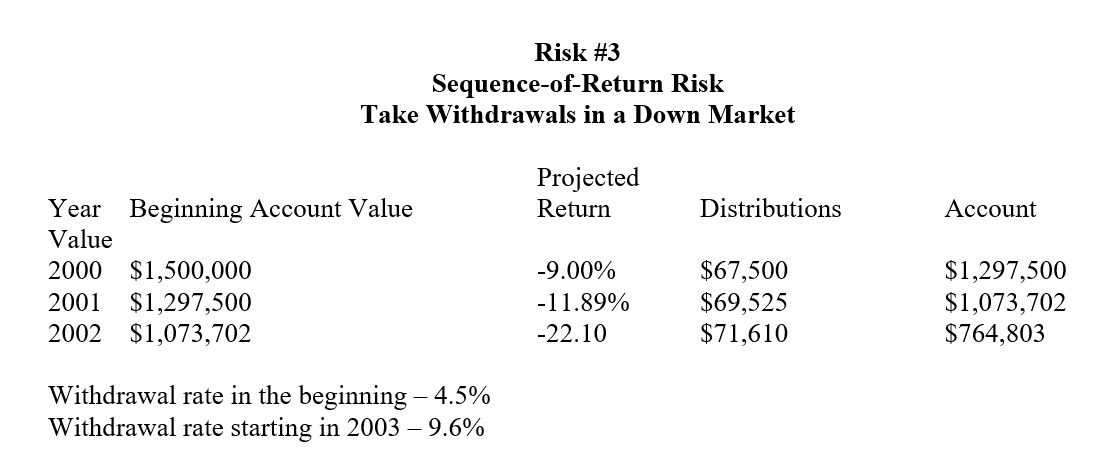

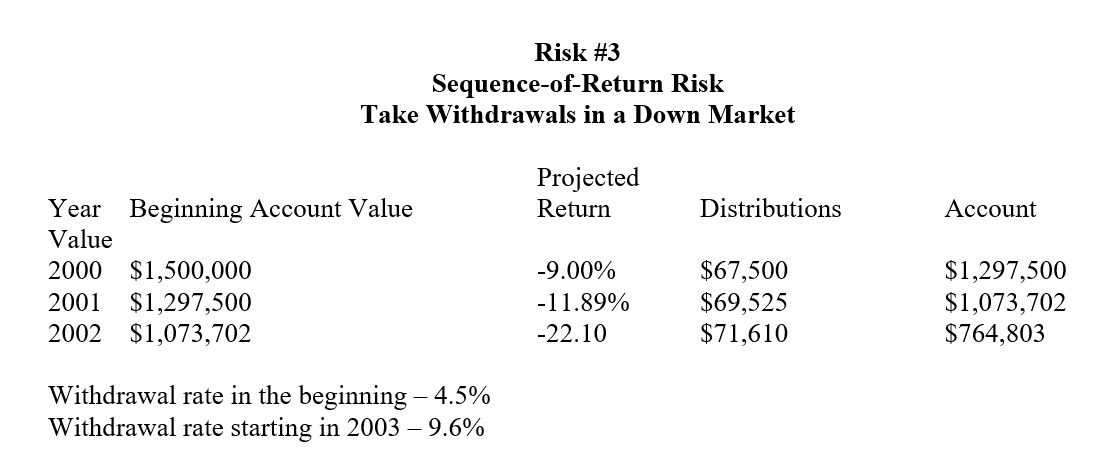

The Deckers lost a large portion of their assets in the initial three years of their retirement.

By maintaining their lifestyle, the Deckers withdrew more money than they should have.

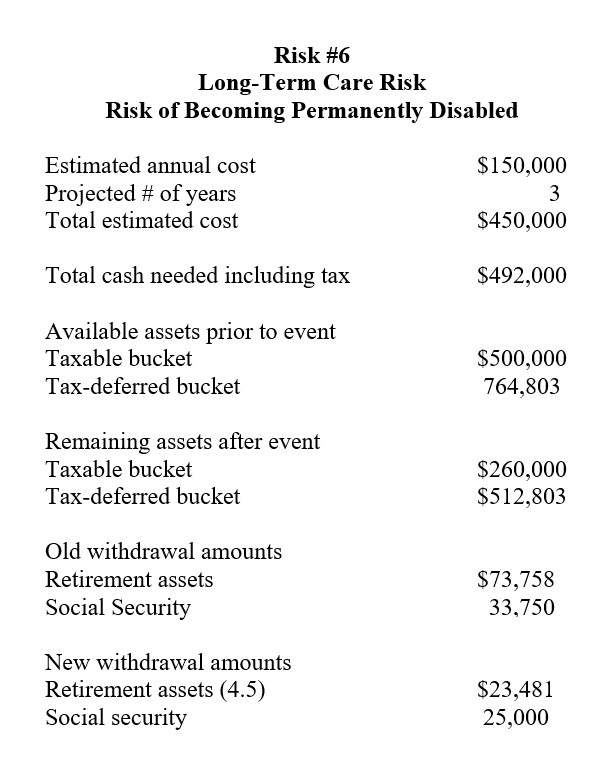

Unfortunately, Robert experiences long-term care and picks a private facility to stay in. Because of the cost, the Deckers would spend more of their assets much faster than planned had Robert did not have the long-term care event. Donna is left with a worse off financial position than before Robert’s passing.

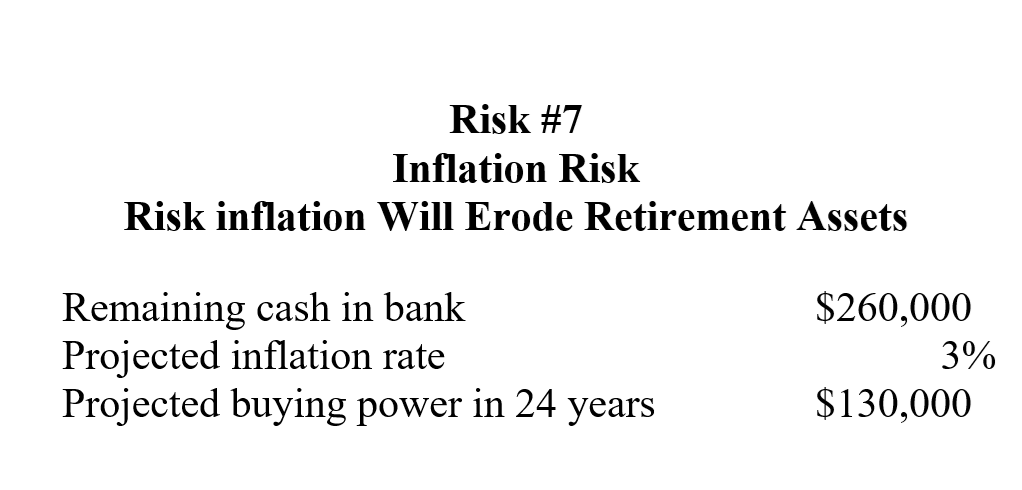

With their only inflation-adjusted income being Social Security, the Deckers are exposed to inflation risk detrimentally impacting their buying power in retirement. Especially after Robert’s death.

The Facts:

Pre-retirement income – $120,000

After-tax income needed in retirement – $90,000

Anticipated inflation rate – 3%

Anticipated rate-of-return – 5%

No life insurance

No long-term care insurance

Their Assets:

Taxable bucket – $500,000 (local bank/CDs)

Tax-deferred bucket – $1,500,000 (Robert’s IRA)

Tax-free bucket – $0

Combined Social Security assuming a full retirement age of 66 – $33,750

Benefits: Increase monthly income and limit out-of-pocket medical expenses in retirement.

Risks reduced or eliminated: Social Security and Medicare risk.

Benefit: Determine life expectancy to inform Social Security claiming and longevity planning.

Risk reduced or eliminated: Longevity risk.

Benefits: Death benefit for long-term care events; tax-free growth and distribution; protection from

market downturns; death benefit for children or charity.

Risks reduced or eliminated: Long-term care risk, tax-rate risk, sequence-of-return risk.

Benefits: Guaranteed, tax-free stream of income for life; less to worry about in retirement when

matched with Social Security income.

Risks reduced or eliminated: Longevity risk, tax-rate risk, sequence-of-return risk, inflation risk,

withdrawal rate risk.

Benefits: Pay taxes while rates are low; build income diversity; allow other assets to settle for a more

secure retirement.

Risks reduced or eliminated: Lack of income diversity risk; tax rate risk.

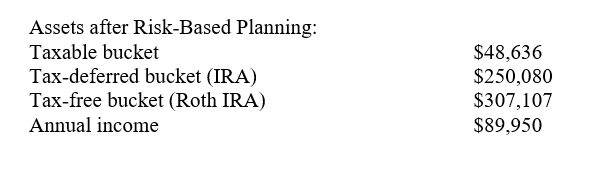

The Deckers assets have been successfully allocated into appropriate retirement buckets, with six months of basic living expenses—inflation-adjusted—in their tax-deferred bucket and all other assets in their tax-free bucket. This gives them more tax-free income than they need, far more than was available under their previous plan.

Roth annuity

Tax-deferred

Social Security

Permanent insurance

The four tax-free income streams described above will help the Deckers mitigate all the financial risks demonstrated. They can live off their Roth annuity and Social Security benefits each month and use their remaining assets for unexpected expenses or to achieve their goals.

Social Security risk: The Deckers maximized their Social Security benefits by waiting until their full retirement age (FRA) to claim, and they allocated their income so that their Social Security is not taxed.

Tax rate risk: The Deckers have no taxable income under their current plan.

Longevity risk: They can enjoy a long life because they have guaranteed income from Social Security and an annuity that will never run out.

Sequence of return risk: The market can go up and down, but it will not impact Robert and Donna’s daily lifestyle because their annuity income is guaranteed. The only assets they have at risk are what is left in their taxable, tax-deferred, and Roth IRA buckets, and these assets are not required for their daily living expenses.

Withdrawal rate risk: The Deckers’ withdrawal rate has been set as part of their financial plan. They can get an above-average withdrawal rate because some of their assets have principal protection.

Long-term care risk: If they need long-term care, they can activate the chronic illness rider on their life insurance policies. This will allow them to access the death benefit early to help cover the cost of long-term care.

Inflation risk: They have inflation-adjusted Social Security and an inflation-adjusted annuity. Their annuity payments will increase as the annuity value increases due to investment growth.

Medicare risk: The Garcias are happy with their Medicare Advantage Plan, but they check it each year to make sure there are no changes to their coverage. If they find changes they are not happy with, they will consult with a broker to look for other alternatives.

Elder abuse risk: This risk has been reduced because they have a plan in place to cover their financial needs throughout their retirement. Donna has the income and structure she needs to maintain her lifestyle even Robert was to pass away early due to complications from a long-term care event.

Lack of income diversity risk: By having four sources of tax-free income, the Deckers are in a great position to continue to manage the financial risks facing their retirement.

Copyright 2023 © RRA Agency | All Right Reserved